Instant Loan Credit + Card: RedCarpet

RedCarpetUp.com

Description of Instant Loan Credit + Card: RedCarpet

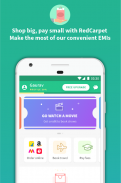

NOW DOWNLOADED BY OVER 1 MILLION+ USERS !

Apply for a Mastercard or Rupay based Ruby Card with Instant Loan Credit + Card: RedCarpet & request loan/udhaar/उधार upto 50,000! Avail thousands of discounts & coupons all over India.

Would you like to live your life uninterrupted? How about getting cash any time you want? Get instant credit loans & shop online or at local vendors by using your Ruby Card. Request to withdraw money using ATM from this credit app today!

Operational Cities:

Delhi, Jaipur, Hyderabad, Chennai, Pune, Dehradun, Kolkata, Vijayawada, Mumbai, Chandigarh, Jalandhar, Bhopal, Bangalore. Use this loan app to make your life easier!

How to use Instant Loan Credit + Card: RedCarpet:

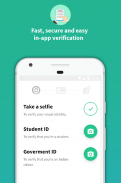

1: Download the RedCarpet App

2: Fill in the required details - like selfie, etc

3: Upload KYC documents (ID & Address Proof)

4: Use Ruby card wherever you want including ATM cash.

5. Receive your starting limit of 500 Rs.

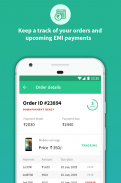

6: Pay later or pay on-time to improve your credit limit. Pay EMI via UPI/Bhim app on RedCarpet app or website. (please note that this does not happen instantly)

7. Unlock the highest borrow money of 50,000 Rs! (please note that this does not happen instantly)

Features of Instant Loan Credit + Card: RedCarpet:

* Track your spending with card app and check your credit score

* Zero interest if you pay in full by the 15th of the month !

* Open for students, salaried, self-employed

* Better than 0% emi - you dont have to take loan beforehand

* 100% transparent loan app - Only used amount will be converted to loan💰

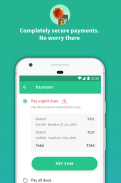

* Affordable & safe - you can pay minimum EMI OR total monthly bill.. (interest charges will apply for minimum amount)

* Ruby card can be used anywhere - Flipkart, Amazon, Paytm, Big Bazaar & restaurants & even ATM cash withdrawal (For chosen users) 🏧

* PAN card, bank statement, etc is not compulsory. We ask for optional address proof, ID card, salary slips, etc

* Request for Cash Loans in bank account,Paytm or UPI Wallet.

* Improve RBI-certified credit bureau (CIBIL) using Ruby Card. This will be beneficial to your future job, EMI & loans.

* ♥♥ Instant Loan Credit + Card: RedCarpet will help you in honest money management. We will take care to not give a loan higher than you can afford ♥♥

Privacy Policy:

RedCarpet believes that your privacy is important. Please check our privacy policy here - https://www.redcarpetup.com/privacy

Security Precautions:

Your data is safe with RedCarpet. It is transferred over a secure HTTPS/SSL connection to us, & we do not share it with anyone without your consent except the Lenders.

RedCarpet is also CISA audited for security

If you find out any unauthorized use of your account or any suspicious activity, we request you to notify RedCarpet Team - help@redcarpet.cash

Honest Disclosure of Permissions:

When RedCarpet collects & uses personal data of our customers, we try to meet the highest standards because our focus is on securing customer information. So, we request a few authorizations from your cell phone:

✓ Location: We initially request your consent & if you agree & give us permission then we track your location. RedCarpet values your privacy.

✓ Contacts: If you allow us to access your contacts, you can invite your friends to try our app & can send across links to your friends.

✓ Email Accounts: For verification & to inform you about EMI reminders + offers.

✓ SMS: If you allow us to access your SMS, we validate your mobile number & use SMS information to create a more standardized credit score.

✓ Photos & Media documents: We do not access your camera or access your photos without your permission. We never scan or import your photo from photo library or camera roll. This permission is needed to upload photos of documents for loan application.

For more details on our privacy policy, visit - https://www.redcarpetup.com/privacy/